german tax calculator married

If you want to check your individual income then use this German tax calculator for married couples and civil partners. Which tax category you belong to depends on your marital status and if you have more than one employer.

Married couples have the following options.

. Please enter a valid email address as you will be sent an email with a calculation. The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202223 and your net pay the amount of money you take home after deductions. Whether its a diesel petrol or electric car motorcycle truck or camper.

This is the reason that makes the use of an income tax calculator so beneficial. Its missing many important tax deductions. Gross Net Calculator 2022 of the German Wage Tax System.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. Without a progression reservation the tax for an income of 26000 Euro would be only 4333 Euro.

2022 2021 and earlier. Your feedback is very important to us to build the best tax solution. If not married Johns tax would be 42 x 75000 EUR - 878090 EUR 22719 EUR.

I can only recommend it. Gross salary of one spouse of EUR 100000 other spouse has no income. It is a progressive tax ranging from 14 to 42.

75000 EUR 0 EUR 75000 EUR. Salary tax is an approximation. Employees pay a salary tax every month.

You can find out which tax category you belong to by for example checking your payslip or tax assessment notice or you can use the following table for orientation. Rental income from German sources of one spouse totals a loss of EUR 5000. Income Tax Calculator Germany Most relevant are VAT and Income Tax.

Tax rates incorporated in the salary calculator Germany that apply for couples. The chart below will automatically visualise your estimated net and gross income. Germany has a progressive tax system.

Couples may earn between 114103 up to 541000. But for parents with a total income above 69027. Have been doing my income tax return via Wundertax for two years and its very well written and easy to use.

With our calculator for motor vehicle taxes you know before buying how tax is due for your new vehicle. These figures place Germany on the 12th place in the list of European countries by average wage. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

Germany has a progressive tax system. Husband John earns 75000 EUR taxable income his wife Mary earns 0. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag.

Online Calculators for German Taxes. 75000 EUR 0 EUR 75000 EUR. If you only have income as self employed from a trade or from a rental property you will get a more accurate result by using.

No employment related expenses exceeding the lump sum allowance of EUR 1000. Salary tax is an estimation of your income tax. For tax purposes whether a person is.

Germany is not considered expensive compared to other European countries the prices of food and housing. This will generate your estimated amount for your Profit and Loss statement. This is a sample tax calculation for the year 2021.

This report is called Anlage EÜR in German. Watch this video tutorial. With this tax rate however only the income without parental allowance is taxed so that the tax amounts to 5044 Euro.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. The calculation is an illustration based on various assumptions and isRead More Germany Salary Tax Calculator 2022. Husband John earns 75000 EUR taxable income his wife Mary earns 0.

Fill in the relevant information in the Germany salary calculator below and we will prepare a free salary calculation for you including all costs that are incurred. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. About the income tax tarif 32a.

Married couple with two dependent children under age 18 years. Married couples can double that sum. If married AND couple taxation is opted for first both incomes are added up.

Singles can earn 8130 EUR per year tax free. I could complete my tax return myself with it. This calculator is useful if you want to find a job in Germany and estimate your cost of living but its not perfect.

Limits of the tax calculator. The calculator will produce a full income tax. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

I did it last year and it was really easy. German Wage Tax Calculator. Then add your private expenses to calculate your taxable income.

For every euro that you earn more the tax burden will rise. Then divided by two. Financial Facts About Germany.

This sum rises in 2014 to 8354 EUR. This German tax calculator allows you to calculate income tax even when one or both partners are self-employed. 2021 every single-parent or married couple receives having a child under 25 - still in professional training living in GermanyEU and which is normally more favourable then the lump sum 8388.

The so-called rich tax Reichensteuer of 45. The logic behind the German tax system. I can just say tops.

Tax Category I applies to you if you are single. There are six tax categories in Germany. Motor vehicle tax calculator.

Income more than 58597 euros gets taxed with the highest income tax rate of 42. Individual assessment Einzelveranlagung with a basic tax rate 26a EStG Joint assessment Zusammenveranlagung with income splitting 26b EStG Divorced and widowed persons are assessed individually. Unfortunately there is no fixed tax rate in Germany that you can apply to your gross salary.

Marriage has significant financial implications for the individuals involved including its impact on taxation. First add your freelancer income and business expenses to the calculator. In return the income tax would amount to 6198 Euro which corresponds to a tax rate of 194 percent.

Start tax class calculator for married couples. There are two exceptions that allow them to still benefit from income splitting. That means that for your first euros of income you will pay a very low tax.

Budget 2022 Income Tax Calculator Assumptions Kpmg Ireland

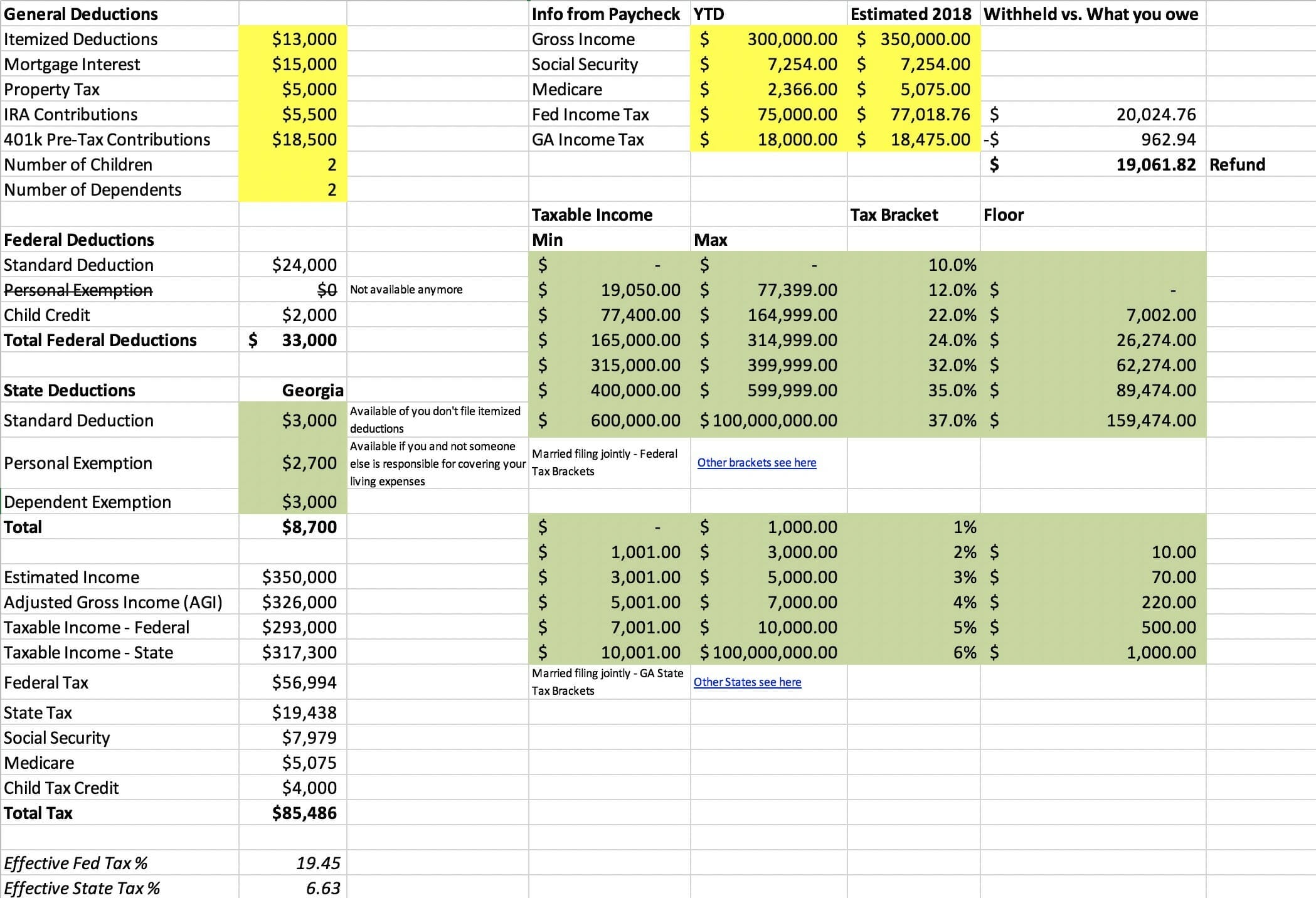

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Using Excel For Tax Calcs Jun 2019 Youtube

German Income Tax Calculator Expat Tax

Calculate Your Taxes In Germany Immigrant Spirit

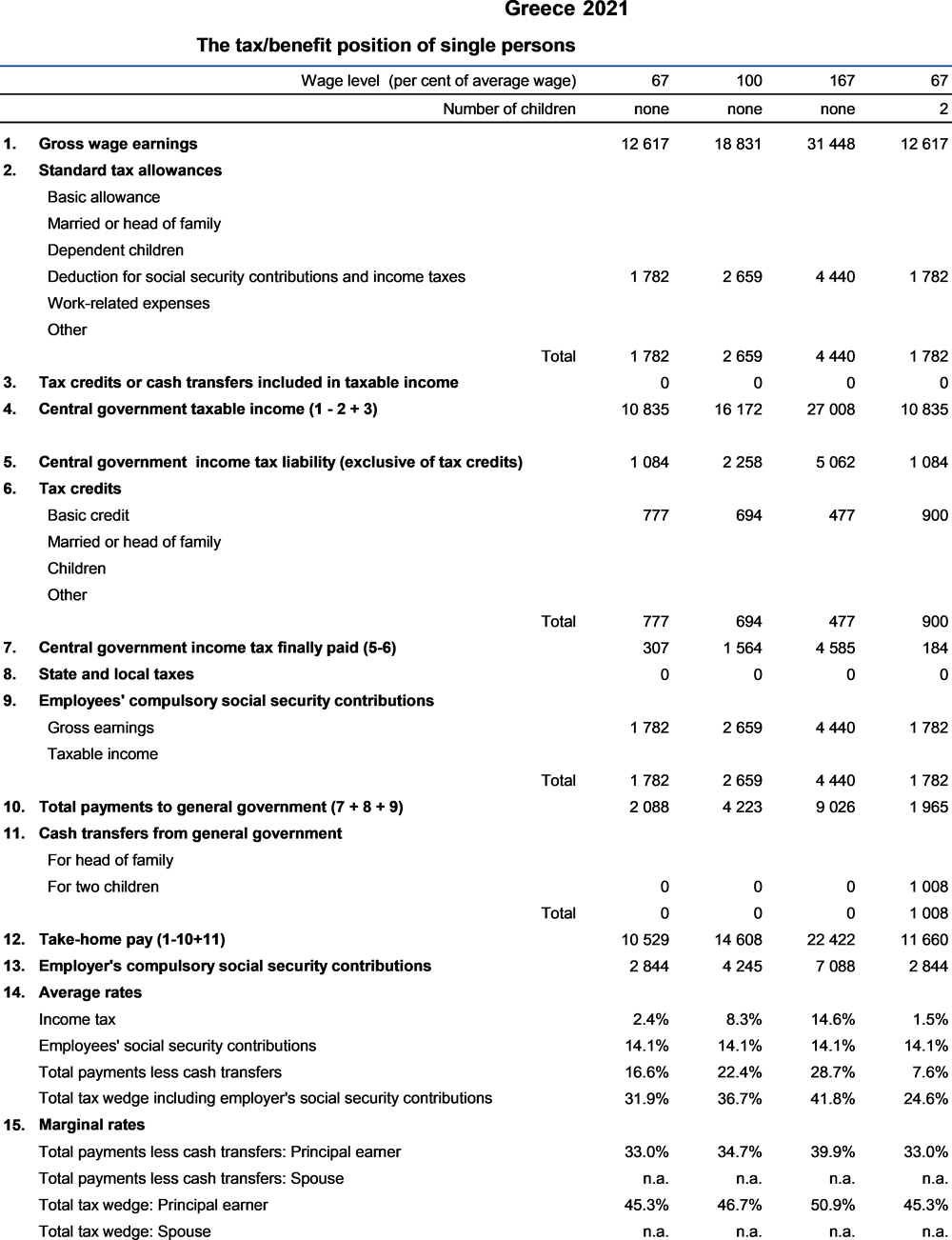

Greece Taxing Wages 2022 Impact Of Covid 19 On The Tax Wedge In Oecd Countries Oecd Ilibrary

4 000 A Month After Tax Ca July 2022 Incomeaftertax Com

Calculation Of The Personal Income Tax Download Table

German Wage Tax Calculator Expat Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax In Germany For Expat Employees Expatica

What Are Marriage Penalties And Bonuses Tax Policy Center

Delay In Stimulus Checks If Tax Was Filed With An Online Tax Preparer Filing Taxes Tax Preparation Small Business Tax

How Is Taxable Income Calculated How To Calculate Tax Liability

Income Tax Einkommenssteuer Ww Kn Steuerberater Fur Den Mittelstand Ww Kn